Popular Articles

A Guide to Debt Consolidation Loans

If you’re considering a debt consolidation loan, our guide will explain all the options to help you make a decision. Debt consolidation loans can be a good way of putting all your debts into one account, to make repayments easier to manage. Before you go ahead, it’s important to understand exactly what they entail and our guide will give you all

Banking

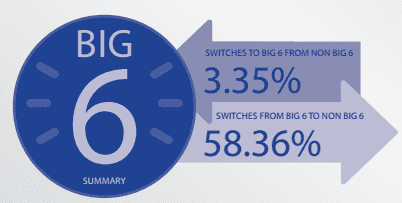

6 Alternatives To The Big 6 Energy Companies

There has never been a better time to leave the much hated "Big Six" energy suppliers. While oil prices and stock markets plummet around the world, energy prices in the UK continue to defy gravity. While the shareholders at British Gas, EDF, Eon, nPower, ScottishPower and SSE will no doubt be delighted at the obscene profits these companies make,

Banking

6 Top Credit Cards For Frequent Flyers

If you regularly take flights, whether for business or leisure purposes, picking up an airline credit card can be great for saving lots of money along the way. Still, the perks on offer, such as free flights and seat upgrades, can differ from card to card – which is why it’s worth looking closely into the available airline credit cards to judge

Banking

7 Top Tips To Improve Your Credit Rating

Your credit rating’s incredibly important. Basically, it determines how likely you are to be given credit when you apply for it – which covers everything from an extension to your overdraft, to applying for a credit card, to getting a mortgage. Want to improve your credit rating?

Banking

A Quick Guide To Mortgages In The UK

Mortgages are a type of loan provided by a Bank or Building Society which is used to purchase a home or a piece of land. Mortgages can, in theory, be for any period of time but the most common type lasts 25 years.

Banking

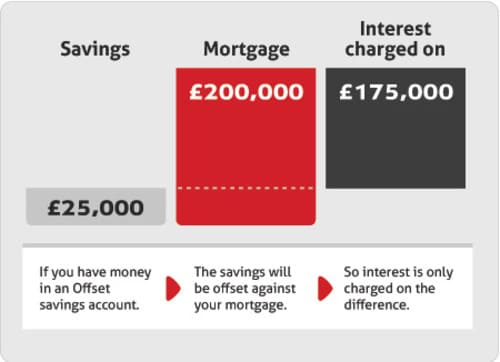

The Benefits Of An OffSet Mortgage - Are You Missing Out?

The Offset Mortgage is growing in popularity as savers continue to struggle to earn a good interest rate on their savings. Interest rates on savings remain at around 1% which means homeowners could benefit by combining their savings and mortgage balances. Offset Mortgages currently only account for 10% of the UK mortgage market.

Banking

The Top Current Accounts To Switch To

With so many different options to choose from, there is no shortage of opportunity to review rates and switch to a personal banking solution that offers favourable terms. However, despite the wide range of offers available, many people remain with their existing current account provider even when their rates are less than competitive.

Banking

Top Online Bank Accounts Reviewed

Online banking is not only very, very convenient, but can also be a good way to get a better bank account. Online only banks and bank accounts generally have less overheads to pay, meaning they can offer their customers better terms. For example, you might find that an online bank account has a better interest rate or overdraft rate. An online bank account can be accessed at any time with no

Banking

Compare 100% Mortgages

Compare our selection of 100% mortgage deals in the table below. If you do not have a deposit for a home, a 100% mortgage might be something to consider. While they are not as readily available as in previous years our mortgage advisors can help you find one. We have access to hundreds of 100% mortgages from all major UK lenders

Banking

Earn £5,000 A Year By Stoozing Your Credit Cards

The word “stoozing” will probably bring back memories for many people who were taking out credit cards ten to fifteen years ago. It was a peculiar phenomenon where, by borrowing money from one institution before depositing it with another with a higher rate of interest, they could basically make money for nothing. So, is stoozing still possible today?

Banking

Fixed Rate vs Tracker & Variable Mortgages: Which Is Best For You?

Generally the old adage ‘safe as houses’ still holds. Houses and the land they stand on are material assets - even if their nominal market value declines the value of houses and land as houses and land remains a constant. At a time when bank savings generally return a negative interest in real terms and

Banking